“Kabusha is a Zulu word for ‘re‑set’ or ‘re‑boot’… nothing could be more relevant in business right now…”

Expanding, acquiring or selling a business? Kabusha Advisory will assist you by providing innovative & robust capital raising and deal structuring solutions.

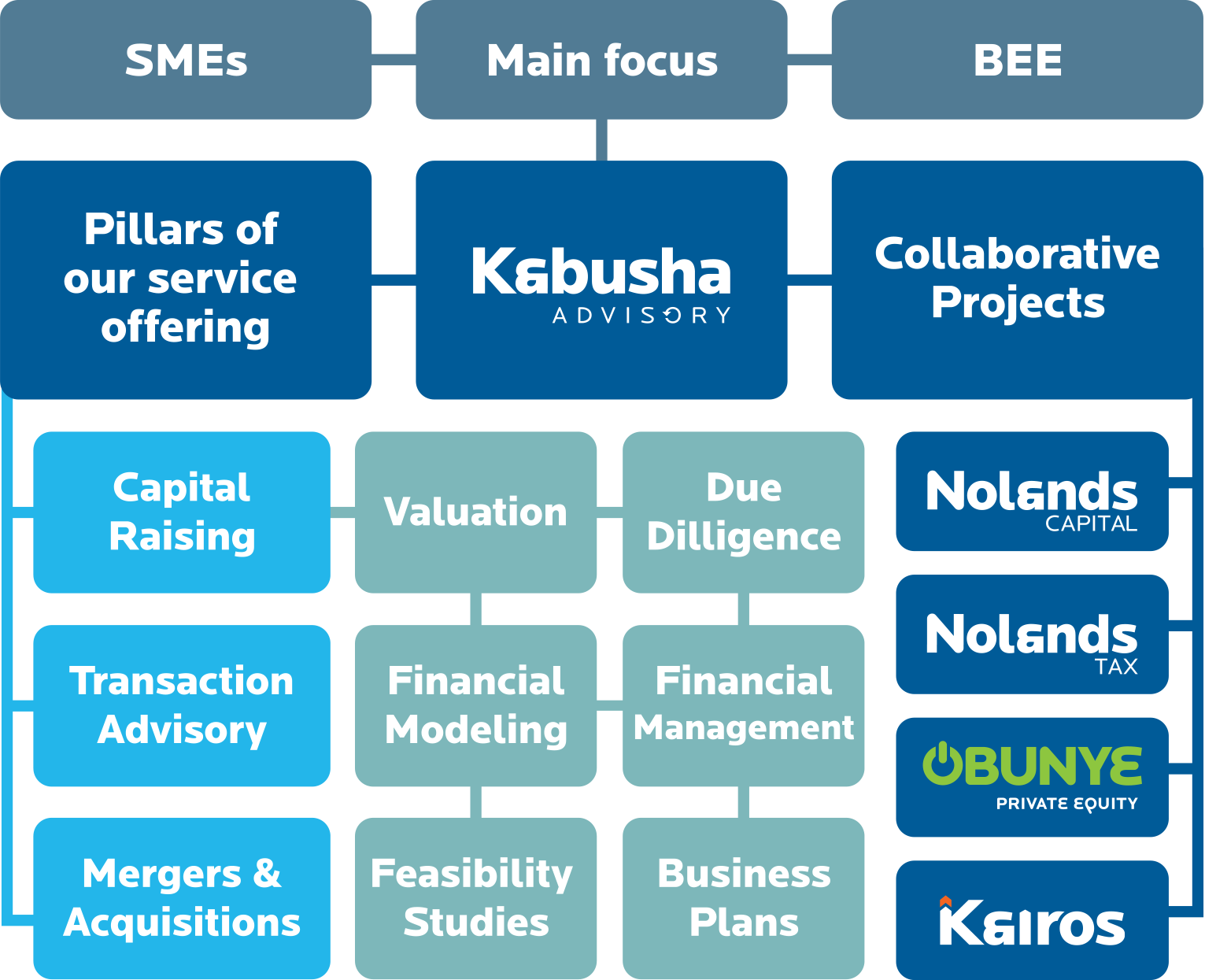

Our main focus

Small and Medium Enterprises – especially those that operate within the BEE space – are our focus at Kabusha. We’ve made it our business to understand specific issues and challenges that affect SMEs; whether it’s advice on a transaction, assistance with raising capital, or any matter relating to mergers or acquisitions, we’re equipped to provide value-adding solutions.

Pillars of our service

We specialise in the following three main areas:

- Capital raising

- Transaction advisory

- Mergers and Acquisitions

The delivery of the above services is achieved through our expertise and experience in areas that relate to valuation, due diligence, financial management, business plans, feasibility studies and financial modelling. Our service offering is tailor-made and fine-tuned to the specific needs of our clients.

Collaborative projects

As a result of strong relationships that we have with Nolands Capital, Nolands Tax, Obunye Private Equity and Kairos, no project is too big or too complex for us to undertake or deliver. When necessary, we collaborate and work closely with one or more of these entities to deliver on our clients specific needs.

Kabusha Advisory – part of a dynamic network

The great thing about networks is that they open up options, not just in a linear way, but exponentially.

Networks are there for joining dots in imaginative paths, and in so doing create something new. A solution that adds value without adding costs, a mix of skill sets that haven’t been combined before.

Networks offer us opportunities to do things in unpredictable, competitively different ways and empower us to create value for our clients.

Steven Msomi | CEO

PhD(Fin), MSc(Fin), INVPR, MIFM

Dr. Steven Msomi is the Founder and CEO of Kabusha Advisory, a mergers

and acquisitions, transaction advisory and capital raising entity based in

KwaZulu-Natal. Equipped with a diverse financial skill set and expertise, Kabusha also offers mentoring and coaching, and a variety of business

support services.

Steven is also the Governor of The South African Institute of Financial Markets (SAIFM); and a Digitlab board member. He has over 20 years corporate experience and has worked in investment banking, mergers and acquisitions, and equity derivative trading roles for companies like SA Stockbrokers, Rand Merchant Bank, FNB Private Clients, PSG-Konsult and Sanlam.

Armed with a PhD in Finance from the University of KwaZulu-Natal (UKZN) and a Masters degree in Applied Finance from the University of Southern Queensland (UQS) in Australia, Steven lectured Investment and Corporate Finance to MBA students at UKZN Graduate School of Business. He has also supervised over 30 Masters dissertations at the UKZN and Nelson Mandela University (NMU).

Clive Noland | Non-Executive Chairman

CA(SA), BCom(Hons)

Clive Noland is the Chairman of Nolands Inc and CEO of Nolands SA, an auditing firm with branches nationally and internationally. He is a Chartered Accountant and founded the company in 1976.

He has gained extensive experience through his involvement as an executive and non-executive director in local and international listed, as well as unlisted companies. He was instrumental in obtaining the Master franchise for Radisson Hotels in the SADEC region and served as CEO of the group until sold to a listed company.

Stuart Noland | Director

CA(SA), MBA, MCom

Stuart specialises in corporate finance and management consulting with specific focus on valuations, mergers and acquisitions and business performance optimisation.

He was part of KPMG’s Financial Engineering Group and has also worked for the company as a practice manager in London. On his return he spent 3 years at Bain Africa as a strategy consultant.

He moved to Nolands Capital in 2019. Stuart is a Chartered Accountant and holds a Masters in Finance (UCT) and a MBA from Oxford.

David Masterton | DIRECTOR

CA(SA), CFE, MDP B-BBEE

David is a Chartered Accountant with extensive knowledge of a broad spectrum of advisory roles.

In his 8 years career with SAPPI as Commercial Manager, he built valuable experience of supply chain management , work flow and system implementation.

David joined Nolands in 2013 in that time has assumed leadership in several aspects of the company’s business, including advising clients on BBEEE strategy, re-structure, M&A and in identifying opportunities and initiating start ups.

Mubeen Maithir | Director

BCom(Acc)

Mubeen has vast experience in his field, making him the perfect fit as Director of Kabusha Advisory. He is highly skilled in valuations, due diligence, varied forms of financial modelling, accounting, income tax and financial statements, with over 10 years of practiced experience in these areas.

Andile Nyandeni | Analyst

MCom(Fin), BCom(Hons), BCom

Andile is an Analyst at Kabusha Advisory. His interests are in financial modelling, valuations, due diligence and research. Andile enjoys deal-making and he hold a Master of Commerce degree from the University of KwaZulu-Natal.

Muzi Lubisi | ANALYST

MSc(Eng), BSc(Hons), BSc(Maths)

Muzi is an Analyst at Kabusha Advisory. His focus is on financial engineering, financial modeling and research. Muzi holds a Master of Science in engineering degree from the University of KwaZulu-Natal.

Kabusha Advisory is able to play a role in consulting to any business to help it succeed

At any stage of a business’s life cycle, the things that combine to make it a success are the same things that need honest and rigorous scrutiny when things go wrong.

Through experience, we know there are 5 key cornerstones on which any business can be analysed:

- People and Management

- Finance

- Operational efficiency

- Market position

- Environmental, social and governance

CONTACT US

For all enquiries on any aspect of our services please contact Steven Msomi directly at stevenm@kabushaadv.co.za.

Alternatively use the messaging board below and we will get back to you.